Newsletter registration

Don’t refuse to mediate! Engage

Smile for the Camera?

ADHD diagnosis and disability

The coroner's duty to notify the DPP

Racist comments from one employee to another

Court of Protection case update: July 2025

Maximising ROI in renewable energy: Legal, technical, and financial strategies for net-zero success

Personal circumstances, public safety, and the planning balance

The Environment (Principles, Governance and Biodiversity Targets (Wales) Bill: the key provisions

Errors of law, materiality and remedies

What next for rent reviews?

Commonhold reform – the beginning of the end?

The CAT’s approach to Subsidy Decision Reviews: Fast, cheap and simple?

Millbrook Healthcare Limited v Devon County Council – Its impact on local government procurement

Early insights into the English Devolution and Community Empowerment Bill

The section 58 defence in the Highways Act 1980

Risk assessments in care proceedings: L-G and Re T

Turbulence ahead

PFI – a new era?

Costs in discrimination claims brought by litigants in person

The Building Safety Act and retrospective service charge protection

Right to Buy (RTB) leases — be warned about service charges

Awaab’s Law – implementation of Phase 1

Seven key insights: Lord Justice Birss considers AI in civil justice

Imperative requirements in homelessness: nuts and bolts on a bumpy roadmap to suitable accommodation

Neurodiversity in the Family Justice System Panel Discussion

Employment Law Webinar Series - May to July - 42 Bedford Row

Home Truths - Dissecting Section 16J: Criminal Confusion in the Renters’ Rights Bill - 42 Bedford Row

Home Truths: Grounds for Possession under the Renters' Rights Bill - 42 Bedford Row

Airport Subsidy Challenged in the CAT

IPA guidance 2025: Managing PFI distress and preparing for expiry

What might the public inquiry on child sexual exploitation look like

Data (Use and Access) Act – Updating Data Protection Law and more

High Court Dismisses Challenge to New Super Prison

AI, copyright and LLMs

Automatic suspensions and the public interest

FOI and communication

Too much?

Deploying ‘ADR’ in Planning & Compensation contexts

Removal from the village green register

The attendance of experts in family proceedings

Local authority enforcement powers and domestic beekeeping

Too little? When intervention is not required

Closures of educational sites

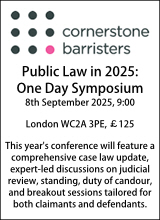

Public law case update Q1 2025

Must read

Families refusing access to support

Must read

Families refusing access to support

Local authorities detect 22% more council tax fraud cases in last year, CIPFA research finds

Local authorities in the UK have detected 22% more cases of council tax fraud compared to last year, research by CIPFA has found.

- Details

This category now accounts for more than three quarters (78%) of all local government fraud.

The 2019 CIPFA Fraud and Corruption Tracker (CFaCT) revealed that UK local authorities identified and/or prevented 71,000 cases of council tax fraud in 2018/19, up from 57,894 cases in 2017/18.

Valued at £30.6m, this included 44,051 cases of Single Person Discount (SPD) fraud and 8,973 cases of Council Tax Reduction (CTR) fraud.

However, this year’s report also showed that the estimated loss to councils from business rate fraud decreased to £8m from £10m the previous year. Overall, business rate fraud represented only 2% of the total number of fraud cases detected or prevented in 2018/19.

Rob Whiteman, Chief Executive, CIPFA: “Fraud continues to be a critical issue for local authorities. Many councils have worked diligently to implement new counter-fraud strategies, and the figures tell us those efforts are working.

“The unlawful diversion of funds away from local authorities only adds further stress on vastly underfunded public services. The sector is moving in the right direction, but only a greater focus on collaboration and preventative measures will help to create long-lasting change.

“CIPFA recognises the significant effort and resource that local authorities have applied in the fight against public sector fraud, which have contributed to councils finding and preventing more instances of fraudulent activity.”

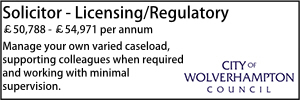

Head of Governance & University Solicitor

Head of Legal Shared Service

Director of Legal and Governance (Monitoring Officer)

Senior Lawyer - Advocate

Locums

Poll

20-08-2025 10:00 am

15-09-2025 10:00 am

08-10-2025 10:00 am

22-10-2025 4:00 pm

05-11-2025 4:00 pm