Infrastructure projects escape worst of the axe as budget delivers at least 25% spending cuts

The Chancellor has announced that infrastructure projects will be spared the worst of government spending cuts in a Budget that otherwise promised deep reductions in council revenues and grants and a one-year freeze in council tax.

The Chancellor said that, over the next four years, there would be no further cuts in capital spending beyond the £2bn per year already outlined amongst the £6.2bn of cuts announced last month. However, the government has promised a fundamental review of which schemes are affordable and will bring the greatest economic benefit, and promised to publish a national infrastructure plan in the Autumn. The Budget also announced the creation of a new organisation, Infrastructure UK (IUK), to work with the Treasury to encourage greater private investment into infrastructure projects.

Specific projects give the go-ahead were the upgrade of the Tyne and Wear Metro, extension of the Manchester Metrolink, the redevelopment of Birmingham New Street station and improvements to the railway lines to Sheffield and between Liverpool and Leeds. A Regional Growth Fund will be created to help fund regional capital projects over two years.

The government also warned that it will monitor lending by the Public Works Loans Board more closely to “ensure that the risks around local authority [prudential] borrowing decisions are better understood” and was looking at introducing greater “transparency” around borrowing taken more than two years in advance of expenditure.

Non-protected spending departments will suffer budget cuts of 25%, although the Chancellor said that the pressure on education and defence means that their budgets will be cut by less than this, meaning that other departments will suffer deeper cuts. Details of how these cuts will fall will be announced in the Autumn's spending review, which will take place on 20th October. Council tax will be subjected to a freeze in the 2011-2012 financial year.

On public sector pay, the Chancellor said that all those earning more than £21,000 per year would be subject to a two-year pay freeze, while employees below this level would each receive an increase of £250 per year across these two years. As reported yesterday, the future of public sector pensions is the subject of a review by former Labour Minister John Hutton, which will present its interim findings in time for the spending review in October.

The Budget confirmed that Local Enterprise Partnerships (LEPs) will be introduced to replace Regional Development Agencies, which will be abolished through the Public Bodies Bill announced in the Queen's Speech. More details are promised in a white paper to be published later this summer, with the aim of “better supporting the coordination of private and public investment in transport, housing, skills, regeneration and other areas of economic development”. The white paper will also look at how local authorities can provide greater incentives to promote economic growth and promises to promote the role of simplified planning consents in areas with greatest potential or need of economic growth.

The Chancellor also announced some significant changes to the provision of housing benefit and social housing. From 2010, housing entitlements for working age people will “reflect family size”, while housing benefit rates will be capped at £250 per week for a one-bed property, £290 for two beds, £340 for three and £400 per week for a four-bedroom or larger homes. From 2011, rates will be set at the 30th percentile of local rents and increases will be linked to the Consumer Price Index from 2013.

The measure to increase the landfill tax by £8 per tonne in each of the years from 2011 to 2014, announced in the previous government's Budget in March will be taken forward, while on business rates, the government said that it will introduce legislation to cancel back-dated business rates bills for properties that have been split away from larger properties, including those in ports.

Finally, the Chancellor said that there would be no further duty rises on alcohol, but announced a review on alcohol pricing to report in the Autumn.

- Details

The Chancellor has announced that infrastructure projects will be spared the worst of government spending cuts in a Budget that otherwise promised deep reductions in council revenues and grants and a one-year freeze in council tax.

The Chancellor said that, over the next four years, there would be no further cuts in capital spending beyond the £2bn per year already outlined amongst the £6.2bn of cuts announced last month. However, the government has promised a fundamental review of which schemes are affordable and will bring the greatest economic benefit, and promised to publish a national infrastructure plan in the Autumn. The Budget also announced the creation of a new organisation, Infrastructure UK (IUK), to work with the Treasury to encourage greater private investment into infrastructure projects.

Specific projects give the go-ahead were the upgrade of the Tyne and Wear Metro, extension of the Manchester Metrolink, the redevelopment of Birmingham New Street station and improvements to the railway lines to Sheffield and between Liverpool and Leeds. A Regional Growth Fund will be created to help fund regional capital projects over two years.

The government also warned that it will monitor lending by the Public Works Loans Board more closely to “ensure that the risks around local authority [prudential] borrowing decisions are better understood” and was looking at introducing greater “transparency” around borrowing taken more than two years in advance of expenditure.

Non-protected spending departments will suffer budget cuts of 25%, although the Chancellor said that the pressure on education and defence means that their budgets will be cut by less than this, meaning that other departments will suffer deeper cuts. Details of how these cuts will fall will be announced in the Autumn's spending review, which will take place on 20th October. Council tax will be subjected to a freeze in the 2011-2012 financial year.

On public sector pay, the Chancellor said that all those earning more than £21,000 per year would be subject to a two-year pay freeze, while employees below this level would each receive an increase of £250 per year across these two years. As reported yesterday, the future of public sector pensions is the subject of a review by former Labour Minister John Hutton, which will present its interim findings in time for the spending review in October.

The Budget confirmed that Local Enterprise Partnerships (LEPs) will be introduced to replace Regional Development Agencies, which will be abolished through the Public Bodies Bill announced in the Queen's Speech. More details are promised in a white paper to be published later this summer, with the aim of “better supporting the coordination of private and public investment in transport, housing, skills, regeneration and other areas of economic development”. The white paper will also look at how local authorities can provide greater incentives to promote economic growth and promises to promote the role of simplified planning consents in areas with greatest potential or need of economic growth.

The Chancellor also announced some significant changes to the provision of housing benefit and social housing. From 2010, housing entitlements for working age people will “reflect family size”, while housing benefit rates will be capped at £250 per week for a one-bed property, £290 for two beds, £340 for three and £400 per week for a four-bedroom or larger homes. From 2011, rates will be set at the 30th percentile of local rents and increases will be linked to the Consumer Price Index from 2013.

The measure to increase the landfill tax by £8 per tonne in each of the years from 2011 to 2014, announced in the previous government's Budget in March will be taken forward, while on business rates, the government said that it will introduce legislation to cancel back-dated business rates bills for properties that have been split away from larger properties, including those in ports.

Finally, the Chancellor said that there would be no further duty rises on alcohol, but announced a review on alcohol pricing to report in the Autumn.

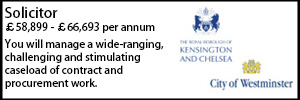

Trust Solicitor (Employment & Contract Law)

Lawyer - Property

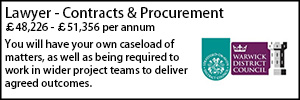

Contracts & Procurement Lawyer

Senior Lawyer - Contracts & Commercial

Locums

Poll