Local Heat Projects

Nicola Sumner, Steve Gummer and Juli Lau set out the key considerations when it comes to localised heating projects.

Nicola Sumner, Steve Gummer and Juli Lau set out the key considerations when it comes to localised heating projects.

- Details

Increasingly local authorities are exploring localised heating projects in order to provide residents and businesses with cost effective and environmentally friendly heating. Localised heating (sometimes called district heating or communal heating) is a system for distributing heat generated in a centralised location through a system of insulated pipes for residential and commercial heating requirements such as space heating and water heating.

What’s happening?

On 16th October 2018, the Department for Business, Energy & Industrial Strategy (BEIS) announced the launch of its Heat Networks Investment Project with news that it had appointed Triple Point Heat Networks Investment Management as its delivery partner. This announcement comes as “Round 8” applications for funding from BEIS’ Heat Networks Delivery Unit are due for submission in December 2018.

Government support for district heating initiatives have increased the feasibility and attractiveness of using local infrastructure such as “energy from waste” facilities as a source of local heat supply.

Central government support may well be the catalyst needed for local community groups and local authorities to take the lead on a modernised decentralised, low-carbon energy landscape.

What is the Heat Networks Delivery Unit (HNDU)?

The HNDU was set up in 2013 by the Government to provide grant funding and guidance to local authorities in England and Wales for heat network project development. It is currently undertaking its eighth round of funding, having awarded over £17m in previous funding rounds [1]

HNDU Funding is available for:

- Heat mapping and energy master planning – area-wide exploration and identification of opportunities.

- Feasibility studies – project-specific detailed investigation of technical feasibility, design, financial modelling, business modelling, customer contractual arrangements and delivery approach.

- Detailed Project Development – development of business/commercial model and financing options; development of procurement strategy; further scheme design; initial scoping/soft market testing and development of commercial agreements.

- Commercialisation – development of contracts and land arrangements; further development of financial model and business case. There is also the potential for preparatory construction works to be included in this phase depending on scheme needs.

What is the Heat Networks Investment Project (HNIP)?

The recently launched HNIP main scheme will be available to public, private and third sector applicants in England and Wales. It is primarily aimed at supporting the contract negotiation and construction stages of a project. It is envisaged that HNIP would offer a seamless transition for projects initially supported by HNDU.

The types of project costs expected to be supported by HNIP include:

- building new heat networks;

- developing existing heat networks, including expansions, refurbishment or interconnection;

- commercialisation phase and construction costs;

- building connections; and

- works to access recoverable heat. [2]

Its key differences from HNDU funding are:

- eligible applicants are not restricted to local authorities; and

- eligible costs relate to the latter stages of heat network projects rather than feasibility and development stages, although there is some overlap at the commercialisation stage.

What are key considerations when looking into localised heat networks?

We broadly categorise the preliminary issues which need to be considered as follows:

Consumer demand for heat – This comprises consumer sign up (this is particularly critical in retrofit schemes) and variable demand. Both of these may impact on expected returns and in turn the pricing for supply of heat.

Effective and reliable technical solution – even a temporary suspension of services can have significant effects on consumers (particularly more vulnerable consumers). Therefore protections are needed. This is usually provided in the form of service guarantees and compensation payments. For heat suppliers it will be critical to adequately specify their system during design, construction and operations (e.g. using industry standards such as CP1).

Implementation challenges – including allocation of risks surrounding the design, build operation and maintenance of infrastructure by contractors – such as allocation of responsibility for obtaining and complying with land rights, planning permission, consents and tenancy rights.

Regulatory compliance – we anticipate a rapidly changing scene in what is currently an arena that is not centrally regulated, but which already presents a host of compliance issues to be aware of, ranging from voluntary recommended codes such as Heat Trust rules to statutory requirements such as consumer rights legislation. In July 2018, the Competition and Markets Authority (CMA) published the final report on domestic heat networks – we expect significant changes to arise from this report in the foreseeable future.

Structure for the delivery model – this includes an understanding of the available corporate structures; (where a local authority) acting within the remit of specified powers (vires); addressing any potential State aid implications; tax implications and efficiency.

Nicola Sumner is a Partner and Head of Infrastructure at Sharpe Pritchard LLP, with extensive experience in the waste, energy and utilities sectors. Steve Gummer is a Senior Associate specialising in infrastructure and utilities, including in the renewable energy and local heating sectors. Juli Lau is an Associate with significant experience in advising public sector clients on waste, energy and local heating projects.

[1] Heat Networks Delivery Unit website https://www.gov.uk/guidance/heat-networks-delivery-unit (last update 16 May 2018)

[2] Delivering Financial Support for Heat Networks, Heat Networks Investment Project https://www.gov.uk/government/publications/heat-networks-investment-project-hnip-scheme-overview (last update 16 October 2018)

Senior Lawyer - Contracts & Commercial

Lawyer - Property

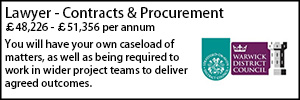

Contracts & Procurement Lawyer

Trust Solicitor (Employment & Contract Law)

Locums

Poll