Clegg unveils power for councils to use tax increment financing

Local authorities are to be given the opportunity to use tax increment financing to fund infrastructure and other capital projects, the Deputy Prime Minister has announced.

In a speech to the Liberal Democrat conference, Nick Clegg said councils would be able to use the new powers to borrow against predicted growth in their locally raised business rates.

He added: “This may not make the pulses race…..but I assure you it is the first step to breathing life into our greatest cities.

“Our leaders in Sheffield say it could allow the redevelopment of derelict mines in the Don Valley; our leaders in Newcastle believe this could help them create a new science park; in Leeds they argue that the Aire Valley could be transformed.

“But whether in Newcastle, Sheffield, in Leeds or indeed in every city in the UK, what matters most is that finally, they will be in the driving seat, instead of waiting for a handout from Whitehall.”

The Treasury insisted that TIF will operate within “a carefully designed framework of rules” that will be designed in co-operation with local authorities.

More detail on the proposed rules – which will require legislation – will be set out in the government’s White Paper on sub-national growth, which is expected to be published around the time of next month’s comprehensive spending review.

Local authorities are currently allowed to borrow against their overall revenue stream but this does not include business rates. “Local authorities will need to manage the costs and risks of this (TIF) borrowing alongside wider borrowing under the prudential code,” the Treasury said.

However, Helen Randall, Head of the Public Sector Commercial Department at Trowers & Hamlins said that the new powers could be of more benefit to areas where growth in business rates is expected to be high, while more economically depressed areas will have less scope to borrow using TIF.

She added that the success of TIF will depend on how much actual freedom Local Authorities are given to use this potentially exciting revenue raising power and whether it will be restricted to capital projects and/or the development of services.

Randall said: “When TIF works well it can create a virtuous circle, promoting long term investment in local business growth. TIF will encourage Local Authorities to redouble their efforts to attract new businesses and help existing local businesses to expand. This could be a useful mechanism if properly structured to soften the blow of impending budget cuts to Local Authorities by offering them the power to borrow against business rates. [However,] local Authorities still face a very challenging funding environment – with or without these new powers.”

- Details

Local authorities are to be given the opportunity to use tax increment financing to fund infrastructure and other capital projects, the Deputy Prime Minister has announced.

In a speech to the Liberal Democrat conference, Nick Clegg said councils would be able to use the new powers to borrow against predicted growth in their locally raised business rates.

He added: “This may not make the pulses race…..but I assure you it is the first step to breathing life into our greatest cities.

“Our leaders in Sheffield say it could allow the redevelopment of derelict mines in the Don Valley; our leaders in Newcastle believe this could help them create a new science park; in Leeds they argue that the Aire Valley could be transformed.

“But whether in Newcastle, Sheffield, in Leeds or indeed in every city in the UK, what matters most is that finally, they will be in the driving seat, instead of waiting for a handout from Whitehall.”

The Treasury insisted that TIF will operate within “a carefully designed framework of rules” that will be designed in co-operation with local authorities.

More detail on the proposed rules – which will require legislation – will be set out in the government’s White Paper on sub-national growth, which is expected to be published around the time of next month’s comprehensive spending review.

Local authorities are currently allowed to borrow against their overall revenue stream but this does not include business rates. “Local authorities will need to manage the costs and risks of this (TIF) borrowing alongside wider borrowing under the prudential code,” the Treasury said.

However, Helen Randall, Head of the Public Sector Commercial Department at Trowers & Hamlins said that the new powers could be of more benefit to areas where growth in business rates is expected to be high, while more economically depressed areas will have less scope to borrow using TIF.

She added that the success of TIF will depend on how much actual freedom Local Authorities are given to use this potentially exciting revenue raising power and whether it will be restricted to capital projects and/or the development of services.

Randall said: “When TIF works well it can create a virtuous circle, promoting long term investment in local business growth. TIF will encourage Local Authorities to redouble their efforts to attract new businesses and help existing local businesses to expand. This could be a useful mechanism if properly structured to soften the blow of impending budget cuts to Local Authorities by offering them the power to borrow against business rates. [However,] local Authorities still face a very challenging funding environment – with or without these new powers.”

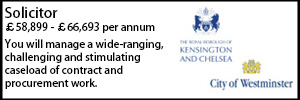

Senior Lawyer - Contracts & Commercial

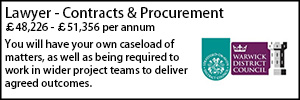

Contracts & Procurement Lawyer

Lawyer - Property

Trust Solicitor (Employment & Contract Law)

Locums

Poll