PFI does not provide good value for money: Treasury Select Committee

The Private Finance Initiative “does not provide taxpayers with good value for money and stricter criteria should be introduced to govern its use”, a group of influential MPs has claimed.

In a report published today (19 August) the cross-party Treasury Select Committee said analysis it had commissioned suggested that paying off a PFI debt of £1bn may cost taxpayers the same as paying off a direct government debt of £1.7bn.

The MPs concluded that:

- Higher borrowing costs since the credit crisis meant that PFI was now an "extremely inefficient" method of financing projects

- Investment could be increased in the long run if government capital investment were used instead of PFI. “The cost of capital for a typical PFI project is currently over 8% – double the long term government gilt rate of approximately 4%”

- Poor investment decisions might continue to be encouraged across the public sector “because PFI allows government departments and public bodies to make big capital investments without committing large sums up front”

- The committee had not seen any convincing evidence that savings and efficiencies during the lifetime of PFI projects offset the significantly higher cost of finance

- Evidence suggested that the out-turn costs of construction and service provision were broadly similar between PFI and traditional procured projects, although in some areas PFI seemed to perform more poorly. The committee heard that design innovation was worse in PFI projects and MPs had seen reports which found out that building quality was of a lower standard in PFI buildings.

- PFI was also inherently inflexible, especially for NHS projects. “This is in large part due to the financing structure and its costly and complex procurement procedure”

- There were concerns that the current Value for Money appraisal system was biased to favour PFIs. There were a number of problems with the way costs and benefits for projects are currently calculated.

The select committee recommended that the Treasury should consider scoring most PFIs in departmental budgets in the same way as direct capital expenditure, adjusting departmental budgets accordingly.

The MPs also called for: the Treasury to discuss with the Office for Budget Responsibility the treatment of PFI to ensure that PFI cannot be used to ‘game’ the fiscal rules; the National Audit Office should scrutinise the Value for Money assessment process; and the Treasury should review the way in which risk transfer is identified.

“In our view PFI is only likely to be suitable where the risks associated with future demand and usage of the asset can be efficiently transferred to the private sector,” the report said. “We recognised that this may, over time, sharply reduce the aggregate value of PFI projects but the higher cost of capital that remains will be easier to justify to the taxpayer.”

The MPs called for PFI to be used “as sparingly as possible” until the Value for Money and absolute cost problems associated with PFI at present are addressed.

Committee chairman Andrew Tyrie MP said: “PFI means getting something now and paying later. Any Whitehall department could be excused for becoming addicted to that.

"We can’t carry on as we are, expecting the next generation of taxpayers to pick up the tab. PFI should only be used where we can show clear benefits for the taxpayer. We must first acknowledge we’ve got a problem. This will be tough in the short term but it should benefit the economy and public finances in the longer term.”

Tyrie added that PFI should be brought on balance sheet, with the Treasury also removing “any perverse incentives unrelated to value for money by ensuring that PFI is not used to circumvent departmental budget limits”. It should also ask the OBR to include PFI liabilities in future assessments of the fiscal rules, he said.

"We must also impose much more robust criteria on projects that can be eligible for PFI by ensuring that as much as possible of the risk associated with PFI projects is transferred to the private sector and is seen to have been transferred."

The Government is expected to report in the autumn on the Treasury’s work to reform PFI.

Tom Symons, Senior Researcher at think tank the New Local Government Network (NLGN) said the inquiry offered a damning critique of PFI but few recommendations for lasting change.

“It’s been clear for a number of years that PFI has a number of benefits, but isn’t always the optimal financing route,” he said. “Central government has effectively forced councils to use PFI, regardless of local circumstances. This needs to change. Local authorities must be free to choose the financing options most appropriate for their circumstances.”

Symons said the solution was a more level and diversified playing field of finance options, with councils able to select the method that best suited their needs.

Philip Hoult

See also: A case for self help?

- Details

The Private Finance Initiative “does not provide taxpayers with good value for money and stricter criteria should be introduced to govern its use”, a group of influential MPs has claimed.

In a report published today (19 August) the cross-party Treasury Select Committee said analysis it had commissioned suggested that paying off a PFI debt of £1bn may cost taxpayers the same as paying off a direct government debt of £1.7bn.

The MPs concluded that:

- Higher borrowing costs since the credit crisis meant that PFI was now an "extremely inefficient" method of financing projects

- Investment could be increased in the long run if government capital investment were used instead of PFI. “The cost of capital for a typical PFI project is currently over 8% – double the long term government gilt rate of approximately 4%”

- Poor investment decisions might continue to be encouraged across the public sector “because PFI allows government departments and public bodies to make big capital investments without committing large sums up front”

- The committee had not seen any convincing evidence that savings and efficiencies during the lifetime of PFI projects offset the significantly higher cost of finance

- Evidence suggested that the out-turn costs of construction and service provision were broadly similar between PFI and traditional procured projects, although in some areas PFI seemed to perform more poorly. The committee heard that design innovation was worse in PFI projects and MPs had seen reports which found out that building quality was of a lower standard in PFI buildings.

- PFI was also inherently inflexible, especially for NHS projects. “This is in large part due to the financing structure and its costly and complex procurement procedure”

- There were concerns that the current Value for Money appraisal system was biased to favour PFIs. There were a number of problems with the way costs and benefits for projects are currently calculated.

The select committee recommended that the Treasury should consider scoring most PFIs in departmental budgets in the same way as direct capital expenditure, adjusting departmental budgets accordingly.

The MPs also called for: the Treasury to discuss with the Office for Budget Responsibility the treatment of PFI to ensure that PFI cannot be used to ‘game’ the fiscal rules; the National Audit Office should scrutinise the Value for Money assessment process; and the Treasury should review the way in which risk transfer is identified.

“In our view PFI is only likely to be suitable where the risks associated with future demand and usage of the asset can be efficiently transferred to the private sector,” the report said. “We recognised that this may, over time, sharply reduce the aggregate value of PFI projects but the higher cost of capital that remains will be easier to justify to the taxpayer.”

The MPs called for PFI to be used “as sparingly as possible” until the Value for Money and absolute cost problems associated with PFI at present are addressed.

Committee chairman Andrew Tyrie MP said: “PFI means getting something now and paying later. Any Whitehall department could be excused for becoming addicted to that.

"We can’t carry on as we are, expecting the next generation of taxpayers to pick up the tab. PFI should only be used where we can show clear benefits for the taxpayer. We must first acknowledge we’ve got a problem. This will be tough in the short term but it should benefit the economy and public finances in the longer term.”

Tyrie added that PFI should be brought on balance sheet, with the Treasury also removing “any perverse incentives unrelated to value for money by ensuring that PFI is not used to circumvent departmental budget limits”. It should also ask the OBR to include PFI liabilities in future assessments of the fiscal rules, he said.

"We must also impose much more robust criteria on projects that can be eligible for PFI by ensuring that as much as possible of the risk associated with PFI projects is transferred to the private sector and is seen to have been transferred."

The Government is expected to report in the autumn on the Treasury’s work to reform PFI.

Tom Symons, Senior Researcher at think tank the New Local Government Network (NLGN) said the inquiry offered a damning critique of PFI but few recommendations for lasting change.

“It’s been clear for a number of years that PFI has a number of benefits, but isn’t always the optimal financing route,” he said. “Central government has effectively forced councils to use PFI, regardless of local circumstances. This needs to change. Local authorities must be free to choose the financing options most appropriate for their circumstances.”

Symons said the solution was a more level and diversified playing field of finance options, with councils able to select the method that best suited their needs.

Philip Hoult

See also: A case for self help?

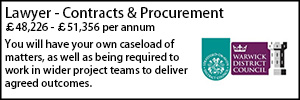

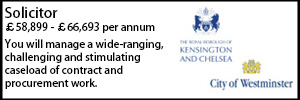

Contracts & Procurement Lawyer

Senior Lawyer - Contracts & Commercial

Lawyer - Property

Trust Solicitor (Employment & Contract Law)

Locums

Poll