SRA sounds alarm over poor practices in high-volume consumer claims

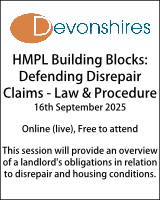

A Solicitors Regulation Authority (SRA) review into how firms process high-volume consumer claims - including housing disrepair and data breach cases - has revealed "widespread issues in the market".

- Details

Key problems highlighted by the regulator included firms failing to consider the best interests of their clients, and clients not being given transparent information on costs, liabilities, or the merits of their claim.

It said that it has since taken the rare step of contacting firms active in the high-volume claims sector, requiring them to complete a mandatory declaration confirming they understand and are following the regulator's rules.

As part of its review, the regulator surveyed 192 firms handling an array of consumer claim types, including financial service/product claims (including mis-sold car finance), diesel emissions, data breaches, flight delays and housing disrepair.

It also visited 25 of the firms to conduct in-person interviews with staff.

The regulator found some firms demonstrated effective compliance with its standards and regulations across all areas of their consumer claims practice.

However, it identified "significant variation" in awareness of, and compliance with, the SRA's standards and regulations at other firms.

Areas of concern included failures to fully consider clients' best interests when entering and managing litigation funding agreements and referral arrangements.

It unearthed a lack of due diligence when entering into new litigation funding and referral arrangements, and "weak systems" and controls to monitor the ongoing compliance of referrers with the SRA standards and regulations.

Elsewhere, the report found that some firms failed to give clients the "best possible information" about the costs of their matter, how it will be funded, and the options available to them.

Clients of some firms were also given inadequate advice about their claim's merits and prospects of success, the report said.

In addition, the review found cases of “poor awareness” of and compliance with regulatory obligations when arranging After the Event (ATE) insurance for clients, as well as inadequate client onboarding processes involving ID checks, sanctions and conflicts of interest.

The SRA is now actively investigating nine of the 25 firms at which it conducted interviews.

Anna Bradley, Chair of the SRA, said: "High-volume consumer claims can provide access to justice for many when done well. However, there are widespread issues in the market, and this is harming consumers.

"We are writing to firms requiring them to declare they understand our rules and are complying with them. Where we see poor practice, we will take robust action."

According to the report, the number of consumer claims is increasing, thanks to the growth of the litigation funding market, consumer law reforms, improved collective redress routes, and developments in legal technology.

Local authorities have been known to warn residents about so-called "claim farmers" who assist tenants in bringing housing disrepair claims against their council.

In 2023, Mid Devon District Council issued a warning about 'no win no fee' firms "who aggressively target vulnerable residents" after it secured £10,000 in legal costs from a claimant who had been encouraged to bring a disrepair claim.

Adam Carey

Solicitor or Chartered Legal Executive

Police Misconduct & Vetting Solicitor

Locums

Poll